The Future of Payments: Why Payment Service Providers Need to Embrace Crypto Rails?

The payment industry is on the inevitable cusp of transformation. The impact of blockchain technology and the adoption of crypto assets as a payment method have become too evident to ignore. Moving away from its volatile and speculative nature, the rise of stablecoin has proven to be the best innovation within the cryptocurrency sector. Furthermore, it holds the key to a promised solution for the trillion-dollar cross-border payment market.

The value of cross-border payments is anticipated to increase significantly, fueled by the rise of borderless e-commerce, international trade, the adoption of digital wallets, and the digital transformation of payment methods across various sectors. It is expected to rise from nearly $150 trillion in 2017 to over $250 trillion by 2027, representing an increase of more than $100 trillion in just a decade.

This changing payment landscape, coupled with add-on pressure on the global payment system, poses a key challenge for Payment Service Providers (PSPs): how to effectively adapt and expand their service offerings to merchants. The article will shed light on how PSPs can partner with crypto payment service providers like BoomFi to reap benefits and effectively position for the future of payment. At the end, merchants and businesses can also find how easy and seamless it is to start accepting crypto payments with BoomFi.

The key challenges

Traditional payment methods are clearly inadequate for both businesses and consumers. The current global commerce environment demands an upgraded global payments system, as cross-border transactions face numerous obstacles, including excessive transaction fees, long processing times, and security concerns.

High Transaction Fees:

The presence of multiple intermediaries in the transaction process can significantly increase fees, which in turn reduces the profit margins for merchants. This situation creates challenges, especially for businesses with high sales volumes or low-profit margins. As a result, even a tiny fee increase can lead to a notable decrease in overall profitability, making it essential for them to find ways to streamline their operations and minimize costs wherever possible.

Slow Cross-Border Payments:

International transactions can significantly affect businesses by often taking several days to process. These delays disrupt cash flow, making it difficult for businesses to manage operations efficiently. In many cases, businesses are left waiting, without visibility into where their money is or when it will arrive. This uncertainty complicates revenue forecasting and may strain relationships with partners who expect timely payments.

Fraud & Chargebacks:

Traditional payment methods expose merchants to significant risks, notably fraud and chargebacks. Fraudsters can exploit these systems, leading to unauthorized transactions and financial losses. Chargebacks, while designed to protect consumers, can create additional burdens for merchants, resulting in lost sales and costs associated with dispute resolutions. This combination of challenges can strain businesses.

All these hurdles have pushed the growing significance of cryptocurrencies as an alternative payment method.

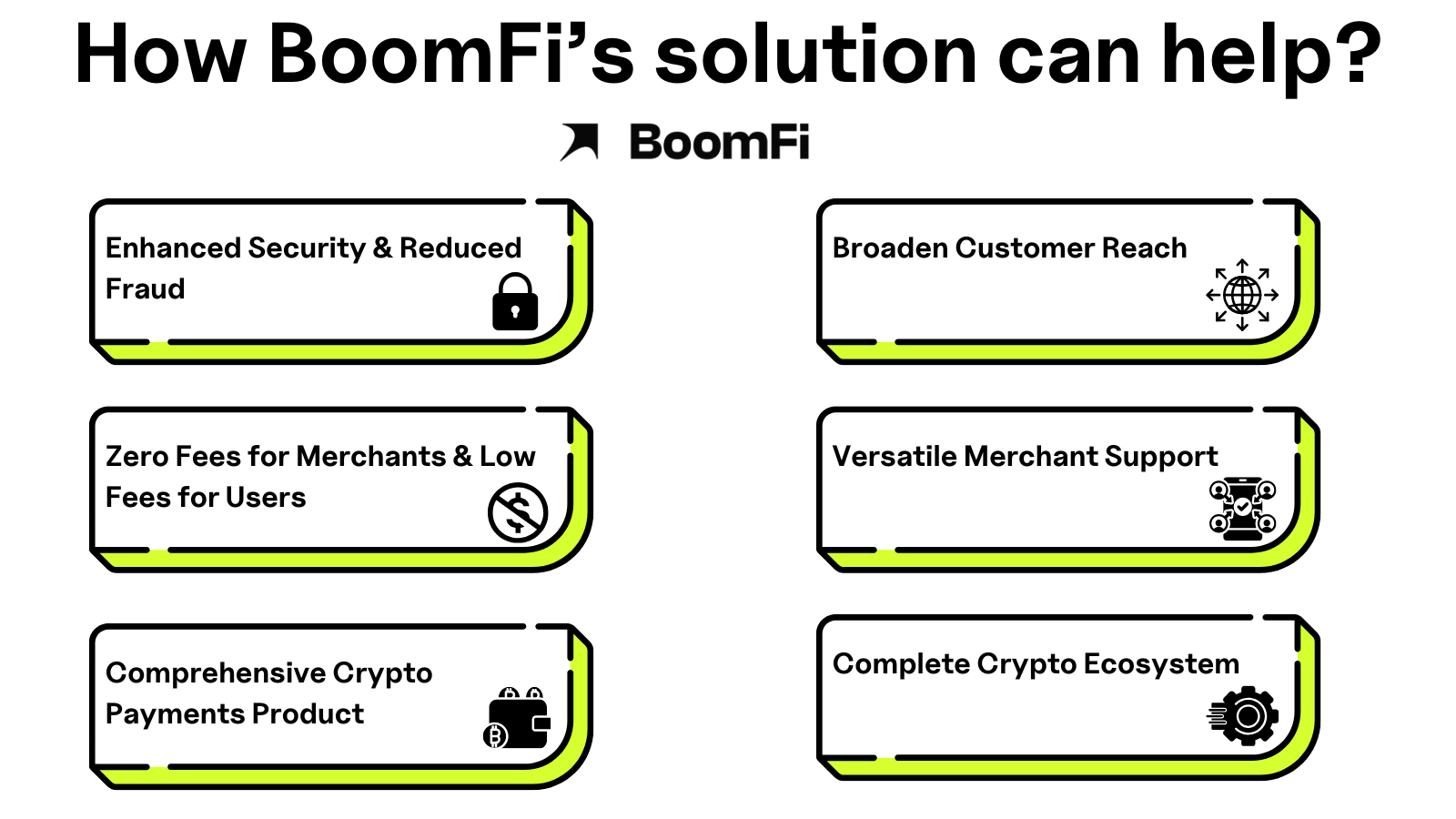

How can BoomFi help?

As a payment infrastructure provider, BoomFi enables the acceptance and processing of cryptocurrency transactions by offering essential systems, tools, and support. At large, we bridge the traditional financial systems with the evolving realm of Web3 payment, fulfilling a core function in the future of the payment landscape.

Broaden Customer Reach

BoomFi empowers PSPs to expand their customer demographics by introducing innovative cryptocurrency payment methods. By tapping into the growing segment of tech-savvy consumers who are increasingly seeking alternative payment options, merchants can attract a global audience that is eager to engage in digital transactions. This positions businesses to gain a competitive edge in the evolving marketplace.

Zero Fees for Merchants & Low Fees for Users

BoomFi offers merchants the option to entirely eliminate merchant transaction fees by shifting to end-user pays. Additionally, BoomFi offers minimal transaction fees for end users, making the process more affordable and accessible for consumers. As a result, both merchants and customers can benefit from reduced financial burdens.

Enhanced Security & Reduced Fraud

By leveraging the inherent properties of cryptocurrency, BoomFi significantly improves transaction security with irreversible payment processes. This mechanism eliminates the risk of chargebacks, which are prevalent in traditional payment methods. With a streamlined focus on security, BoomFi drastically minimizes the potential for fraud, providing a safer environment for both merchants and consumers.

Versatile Merchant Support

Understanding the diverse needs of businesses, BoomFi accommodates a broad spectrum of merchants, including those categorized as low, medium, and high-risk. This versatility ensures that a wide array of business types—from e-commerce startups to established enterprises—can find tailored solutions that meet their payment processing requirements.

Comprehensive Crypto Payments Product

BoomFi boasts robust and diverse payment solutions that address various transactional needs. Merchants can utilize features such as pay-by-link options for simple transactions, recurring payment possibilities for subscription services, in-person terminal payments, crypto-custody, fiat and stable coin settlement and seamless protocols for crypto deposits and withdrawals. The comprehensive nature of these offerings ensures smooth integration into existing business processes, enhancing operational efficiency.

Complete Crypto Ecosystem

Positioned as a holistic provider, BoomFi is a payments partner for all cryptocurrency-related needs. By delivering a complete end-to-end digital assets infrastructure with relevant VASP licenses, BoomFi equips PSPs and merchants with the tools required to navigate the complexities of the crypto landscape. Whether businesses want to explore new payment options or require specific crypto products, BoomFi stands ready to support their journey at every step.

Concluding remark

BoomFi’s solution can offer any PSP and FinTechs wishing to start accepting, processing, or interacting digital currencies. This means merchants can also get ready to manage crypto payments, custody,y and payout from day one. Partnering with payment providers like BoomFi, PSPs are well-positioned to provide hundreds and thousands of merchants and businesses with a crypto payment solution that advances the capabilities of your current offering from accepting crypto payment as an alternative payment method to offering stablcoin settlement to your merchants.,

Don’t just take our word for it, Paymid, a leading payment orchestration, already leverages our solution.

Feel free to check it out:

Blog/The Future of Payments: Why Payment Service Providers Need to Embrace Crypto Rails?

Blog/The Future of Payments: Why Payment Service Providers Need to Embrace Crypto Rails?