Stablecoin Revolution: The Biggest Catalyst for Crypto Payment System

Stablecoin was created in response to the demand for an alternative to cryptocurrencies, offsetting the volatility and providing a more stable means of financial transactions. Fast-forward and stablecoin markets have steadily grown, settling more than $10.8 Trillion worth of transactions in 2023.

Utility Adoption is growing.

In the recent a16z’s State of Crypto Report 2024, stablecoins were cited as the most obvious “crypto's killer app.”

And they were not wrong. Stablecoin has come a long way since 2021, and its revolution just started. Its prime value proposition, making transactions faster and cheaper, has helped it find product market fit in this increasingly competitive market.

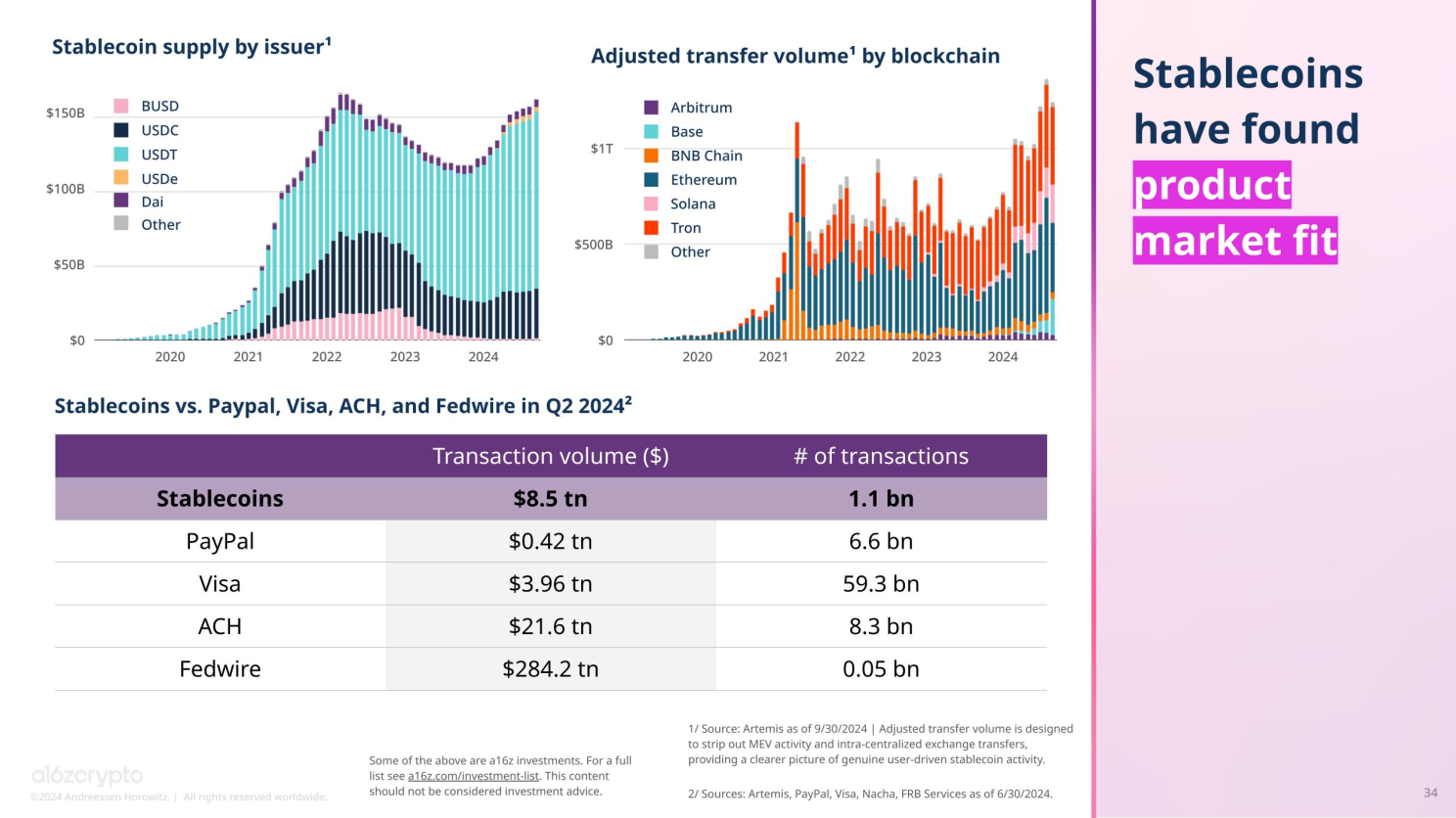

In Q2-2024, stablecoins had a total transaction volume of $8.5 trillion, spread across 1.1 billion transactions. This is a remarkable feat, as stablecoin transaction volume is almost twice that of Visa and PayPal combined. Seeing stablecoins standing next to the payment industry’s incumbents like PayPal, Visa, ACH, and Fedwire is a wake-up call to all non-believers in their usability.

However, one can still argue that stablecoins are primarily used for larger transfers, and there is still a long way to go before stablecoins reach the same level as Visa has for daily purchases such as coffee and groceries. While this is true to some degree, as previously mentioned in our article, 39% of survey users in emerging markets have already adopted stablecoin for goods and services transactions, and 29% used it to pay and receive salary.

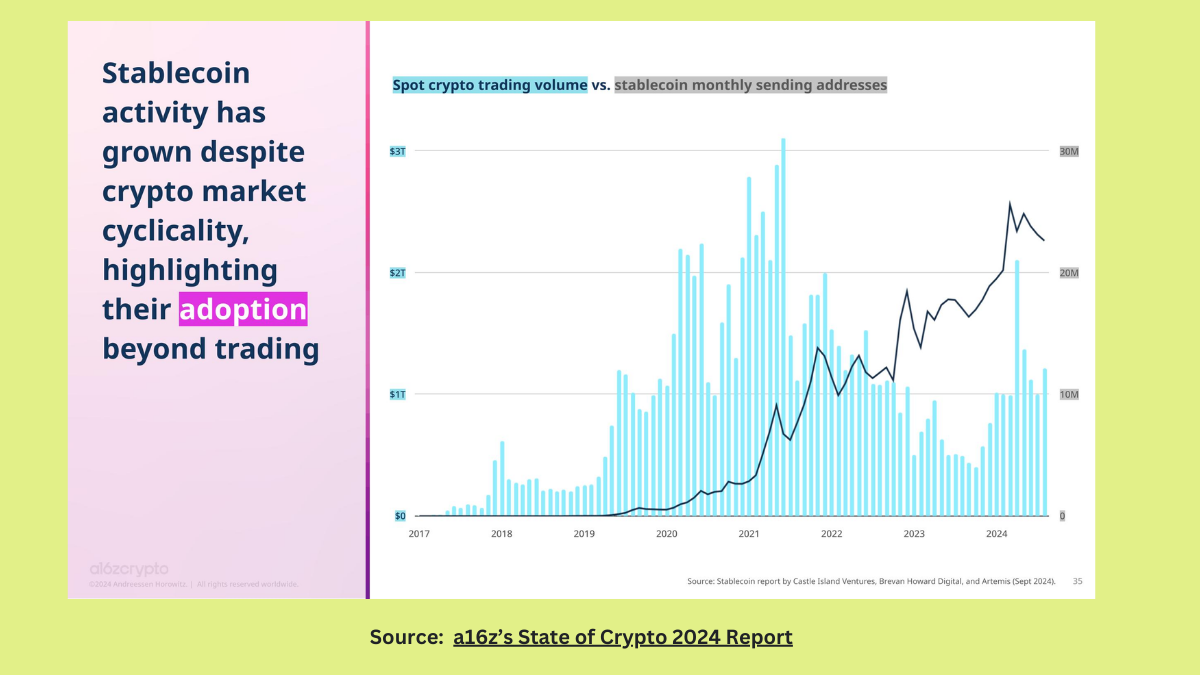

Despite their origin, stablecoins have always been negatively associated with crypto, as many believe their traction is only related to trading and speculative activities. To this point, we have seen Argentinians increasingly utilizing stablecoins as an alternative store of ARS’s value to combat the country’s out-of-controlled inflation.

Moreover, the data indicated that stablecoin activity has become uncorrelated with speculative activities, highlighting the organic growth of stablecoins beyond mere trading.

Then comes the biggest M&A in crypto history.

Stripe, the payment giant, has acquired Bridge, a stablecoin platform, for $1.1 Billion.

Many have compared the acquisition to Facebook's, now Meta's, previous acquisition of Instagram. The comparison has not only highlighted the great synergy but also elevated the massive potential of stablecoin.

Bridge provides software that helps businesses accept stablecoin payments and simplifies the infrastructure. By tapping into Bridge’s stacks, Stripe effectively gets access to a 24/7, instant, and global-based rail that allows them to provide stablecoin benefits to customers across 195 countries without dealing with the complexity of crypto infrastructure.

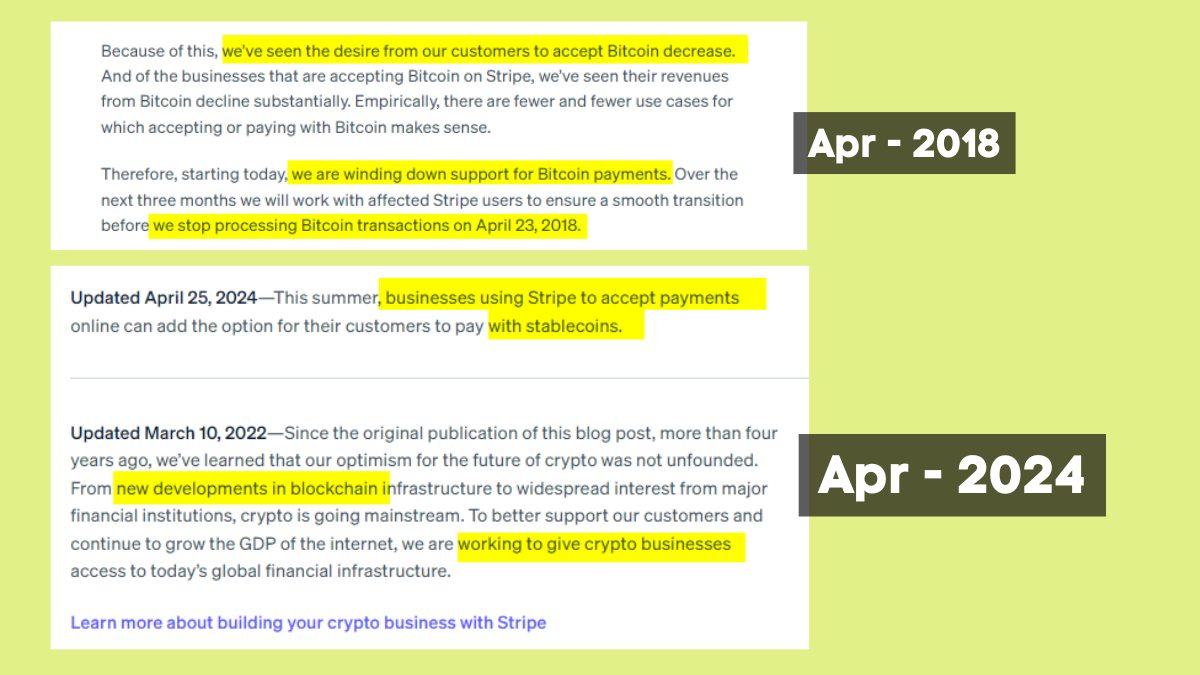

It is worth noting that Stripe’s conviction in crypto has not always been smooth sailing. In 2018, while leading in accepting Bitcoin payments, the company shut down the service. After a six-year hiatus, Stripe has come out with a newfound conviction. The acquisition reinstates Stripe’s optimism in the crypto space and its advancement towards the stablecoin sector.

As the saying goes, be so good that they cannot ignore you. The acquisition has shifted the narrative for crypto from about the price to a practical use case, shrugging off the opportunistic nature and adopting a more business-driven one.

What does it mean for traditional payment service providers (PSP)?

Is it the $1.2 trillion in monthly transaction volume that finally forced the giant Stripe to fully realize the value of stablecoins? The fact is that stablecoin infrastructure is inherently complex. Each new medium for moving money requires new infrastructure, from cryptocurrencies to credit cards or vice versa. Moving stablecoins in a way that is cost-effective, instant, and compliant is even more complicated with different chains such as Ethereum, Solana, and BNB that come with various coins like USDC, USDT, or PYUSD (PayPal).

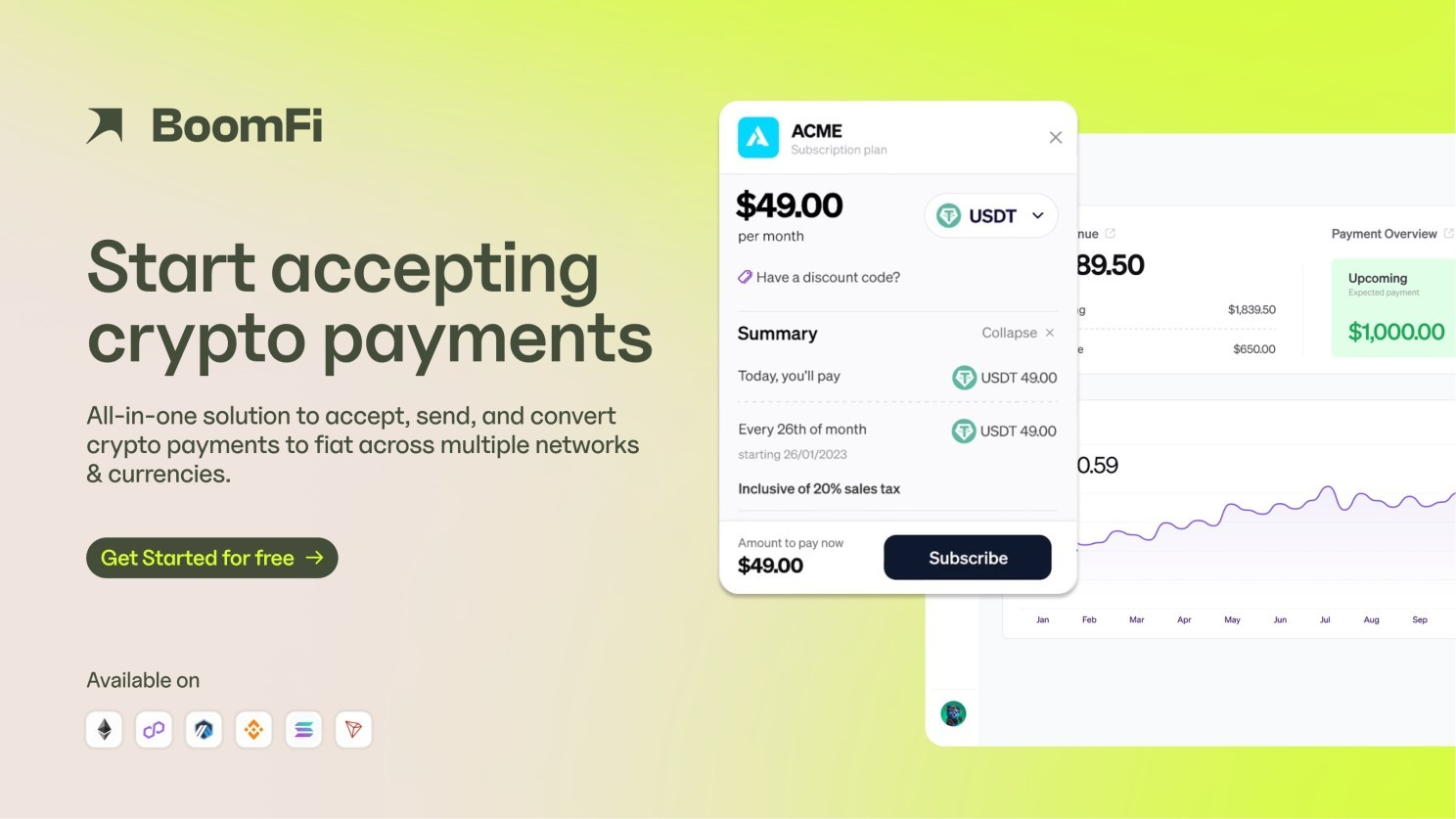

This is where crypto payment solutions like BoomFi come into play. Like what Bridge does to Stripe, BoomFi provides an efficient bridge for fiat service providers looking to tap into the expanding digital currency space without the complexities of direct integration. To keep up with the rising demand for crypto payment methods, offering 24/7 instant dollar liquidity of stablecoins has become a must for merchants and businesses wanting to expand their global customer base. By partnering with BoomFi, payment service providers can focus on offering their global clients the most seamless and user-friendly fiat-crypto payment experience without diverting resources into the complex task of building in-house crypto capabilities.

Parting thoughts

The rise of stablecoins has created an opportunity for traditional fiat payment service providers to adopt cryptocurrency as a viable payment method. In an increasingly digital and on-chain economy, meeting the demands of merchants and businesses looking to expand their reach to a growing global consumer base is essential for staying competitive. Crypto payment methods can help achieve this goal.

However, there’s no need to navigate this transition blindly. By leveraging BoomFi's expertise, payment providers can focus on their core operations while BoomFi manages the complexities of cryptocurrency transactions. This ensures that transactions are smooth, secure, and compliant with regulations. This partnership model not only enhances operational efficiency but also positions traditional payment providers to embrace the future of payment.

The time to act is now!

Blog/Stablecoin Revolution: The Biggest Catalyst for Crypto Payment System

Blog/Stablecoin Revolution: The Biggest Catalyst for Crypto Payment System