Crypto Tax-Free Countries: A Guide to Minimizing Taxes on Cryptocurrency

Discover the top crypto tax-free countries to minimize taxes on your cryptocurrency gains. From Malta to Switzerland, find the best jurisdictions for tax optimization.

Introduction

In the dynamic realm of cryptocurrency investments, navigating the complex landscape of taxes is a paramount concern for enthusiasts and investors alike. As the digital asset market continues to flourish, so does the scrutiny from tax authorities worldwide. In this comprehensive guide, we explore the allure of "Crypto Tax-Free Countries," offering invaluable insights into jurisdictions where investors can strategically position themselves to minimize taxes on their cryptocurrency gains. From the picturesque Blockchain Island of Malta to the financial haven of Switzerland, embark on a journey through nations embracing cryptocurrency with favorable tax policies. Whether you're a seasoned investor or a newcomer to the crypto sphere, this guide aims to illuminate the path toward optimizing your financial strategy in a tax-efficient manner. Welcome to a world where crypto and tax harmony coexist – a guide designed to empower you on your quest for tax-friendly jurisdictions in the ever-evolving landscape of digital assets.

What countries offer tax-free cryptocurrency transactions?

Several countries around the globe have emerged as havens for tax-free cryptocurrency transactions, providing a sanctuary for investors seeking to optimize their financial strategies. Among these crypto-friendly jurisdictions, nations such as Malta, Germany, and Singapore stand out as pioneers in fostering environments where digital asset transactions remain untaxed or subject to significantly favorable conditions. Malta, often referred to as 'Blockchain Island,' boasts a tax regime that exempts long-term cryptocurrency holdings from capital gains taxes. Germany extends tax exemptions to private investors holding cryptocurrencies for over a year, while Singapore adopts a capital gains tax-free approach for individual investors. These nations, along with others like Switzerland and the Cayman Islands, present enticing opportunities for those aiming to navigate the crypto landscape with minimal tax implications, offering a promising haven for enthusiasts and investors alike.

Are there any nations that do not require cryptocurrency taxation?

- Malta: Known as 'Blockchain Island,' Malta has positioned itself as a crypto-friendly jurisdiction. Long-term holders benefit from an exemption from capital gains tax. However, day-trading activities may incur income tax obligations, making it crucial for investors to navigate the nuances of Malta's tax policies.

- Germany: Germany stands out for considering cryptocurrencies as private money, exempting them from taxes if held for over a year. Short-term gains below €600 remain untaxed, offering a favorable environment for long-term crypto investors. However, businesses engaged in crypto activities face corporate income taxes.

- Singapore: Singapore has become a haven for individual cryptocurrency investors as it imposes no capital gains tax on crypto holdings. The government views cryptocurrency as tax-free property for individuals. On the other hand, businesses dealing with cryptocurrencies are subject to income tax, highlighting the need for careful consideration based on one's financial activities.

- Switzerland: Known as a global crypto haven, Switzerland provides tax breaks for individual traders. Capital gains tax is nonexistent for those buying, selling, or holding cryptocurrencies. However, cryptocurrency mining is considered self-employment, attracting income tax implications. Potential investors should also be aware of other wealth and cantonal taxes that might apply.

- Cayman Islands: The Cayman Islands, a traditional tax haven, boasts a tax-friendly environment for cryptocurrency enthusiasts. With no capital gains or income taxes, it provides an attractive option for those seeking to minimize their tax liabilities. However, individuals should consider the high cost of living and potential import duties on goods.

- Belarus: Belarus took a groundbreaking step in 2018 by legalizing cryptocurrencies and offering tax exemptions until at least 2023. This has made the country appealing for crypto mining and investments, aligning with its commitment to fostering digital innovation.

- Bermuda: Bermuda has positioned itself as a tax haven for digital assets. With no taxes on digital assets or transactions, the jurisdiction provides a favorable environment for cryptocurrency investors. Notably, taxes incurred can even be paid using digital coins like USD Coin.

- British Virgin Islands: The British Virgin Islands, a renowned tax haven, extends its favorable tax policies to cryptocurrencies. With neutrality in terms of capital gains, corporate income, or withholding taxes, the jurisdiction provides a conducive environment for those involved in crypto transactions.

- Hong Kong: Hong Kong offers a tax-friendly atmosphere for individual cryptocurrency investors by exempting capital gains tax for investment purposes. However, businesses engaged in regular crypto trading may find themselves subject to income tax obligations, emphasizing the importance of understanding the tax implications based on the nature of activities.

- Malaysia: Malaysia has established a nuanced approach to cryptocurrency taxation. Infrequent individual investors enjoy tax-free status, but active traders may face capital gains tax. Navigating these distinctions is crucial for those considering Malaysia as their crypto tax haven.

- Slovenia: Slovenia, while currently favorable for individuals without capital gains tax, is in the process of evaluating its crypto-tax landscape. Pending legislation may introduce changes, making it essential for potential investors to stay informed about regulatory developments.

- El Salvador: El Salvador made history by recognizing Bitcoin as legal tender and exempting income, capital gains, and property taxes related to cryptocurrencies. This progressive stance positions El Salvador as a unique destination for cryptocurrency enthusiasts seeking a tax-free environment.

- Portugal: Portugal offers an attractive environment for crypto investors, declaring tax-free status on crypto profits generated from selling or trading. The Portuguese government's favorable stance on crypto trading and income positions the country as a sought-after destination for those aiming to minimize tax obligations.

- United Arab Emirates (UAE): The UAE stands out as a tax-friendly jurisdiction for individual investors, with no income or capital gains tax on crypto transactions. However, the 5% VAT on goods and services, including those purchased with cryptocurrencies, is a consideration. The UAE's high cost of living is another factor individuals should weigh.

- Puerto Rico: While not an independent country, Puerto Rico's distinct tax policies make it noteworthy. Residents enjoy lower federal income tax rates than in the mainland USA, and there is no capital gains tax on digital assets acquired and disposed of while residing in Puerto Rico. The territorial income tax rates, ranging from 0-33%, make Puerto Rico an appealing option for US citizens.

- Estonia: Estonia has gained recognition for its e-residency program and favorable tax environment. While it doesn't impose capital gains tax on crypto, businesses engaged in crypto-related activities may face corporate income tax. Estonia's innovative approach to digital governance makes it an intriguing option for tech-savvy investors.

- Antigua and Barbuda: Antigua and Barbuda have embraced cryptocurrency adoption, with Bitcoin Cash gaining widespread acceptance. While specific tax policies on crypto transactions may vary, the general crypto-friendly atmosphere, along with a scenic Caribbean backdrop, adds to the appeal for crypto enthusiasts.

- Luxembourg: Luxembourg has emerged as a hub for financial services, and its approach to cryptocurrency reflects this openness. Individual investors enjoy a capital gains tax exemption, making Luxembourg an attractive destination for those seeking a tax-efficient environment for their crypto holdings.

- The Bahamas: The Bahamas, known for its beautiful beaches, also offers a tax-friendly atmosphere for crypto investors. With no capital gains tax, income tax, or corporate tax, it provides a straightforward tax structure. However, potential investors should consider factors beyond taxes, such as lifestyle and residency requirements.

- Barbados: Barbados has positioned itself as a jurisdiction conducive to digital nomads and remote workers. While specific crypto tax regulations may evolve, the absence of capital gains tax on crypto transactions adds to Barbados' appeal for those exploring tax-efficient options.

- Anguilla: As a British Overseas Territory, Anguilla has gained attention for its lack of capital gains tax on cryptocurrency transactions. The jurisdiction's commitment to privacy and a favorable tax environment make it an intriguing option for those seeking a tax-free approach to crypto investments.

- Liechtenstein: Liechtenstein, nestled between Switzerland and Austria, has embraced blockchain and cryptocurrency technologies. While individual investors may benefit from a capital gains tax exemption, businesses engaged in crypto-related activities may face corporate income tax. The principality's strategic location and favorable regulations make it a noteworthy player in the crypto space.

- Panama: Panama's strategic location and well-established offshore services make it a consideration for crypto investors. The absence of capital gains tax on crypto transactions aligns with Panama's pro-business environment. As with any international investment, understanding local regulations and seeking professional advice is essential for a comprehensive strategy.

These nations offer diverse opportunities for cryptocurrency enthusiasts, providing favorable tax conditions or complete exemptions, depending on the specific regulatory landscape and individual circumstances.

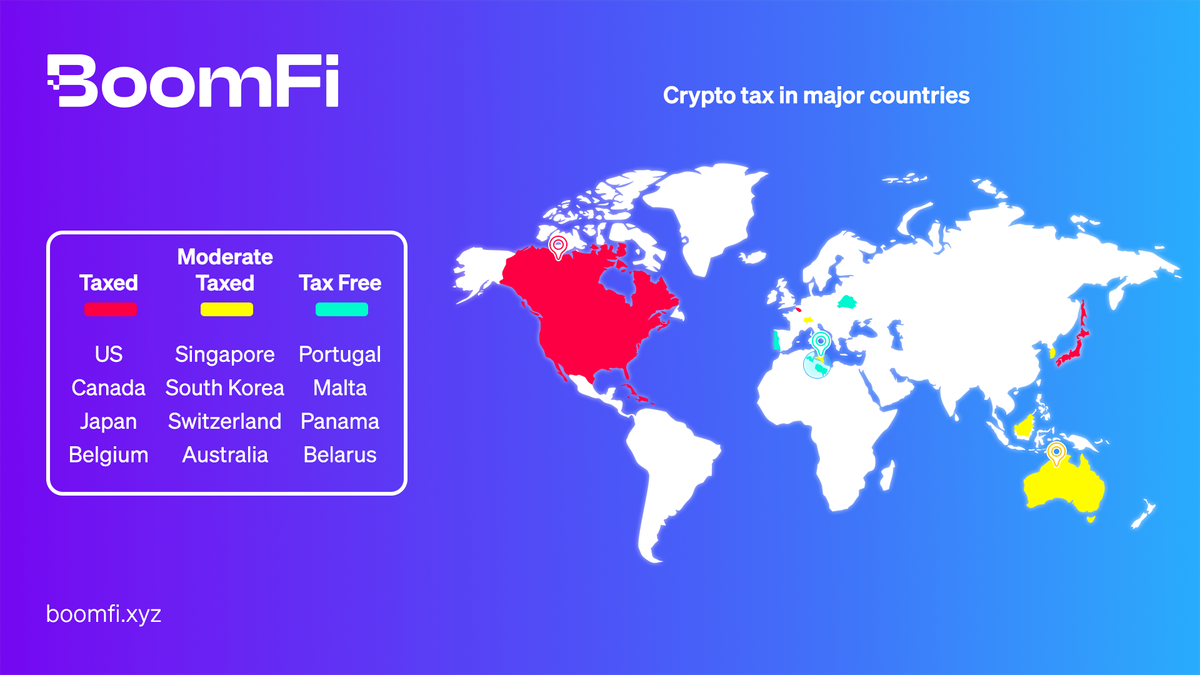

Which nations have the worst cryptocurrency taxes?

When exploring cryptocurrency taxation, it's crucial to be aware of countries with less favorable conditions, posing challenges for investors. Here's an in-depth look at some of the worst countries for crypto tax:

Spain: Spain introduces limitations on offsetting capital losses against gains, allowing only 25% of the value of capital losses to be used. Additionally, cryptocurrency income can be taxed as high as 47%, imposing a substantial burden on investors. Wealth tax is another consideration, affecting residents with a net worth surpassing €700,000, which includes the valuation of crypto assets.

Denmark: In Denmark, the tax landscape for crypto investors includes the restriction that only 30% of losses can be offset by capital gains. The average income tax rate for profits from cryptocurrency is estimated to be around 45%, contributing to a less favorable environment for investors in the crypto space.

The Netherlands: The Netherlands applies taxation to both crypto and non-crypto capital assets, regardless of whether they have been sold. For portfolios exceeding €57,000, a 32% tax is levied on 'presumed gains.' This unique taxation approach may result in unfavorable outcomes for investors, irrespective of the actual performance of their portfolios.

South Africa: One of the challenges in South Africa is the lack of clarity regarding whether crypto transactions should be subjected to capital gains or income tax. The substantial difference between the top income tax bracket (45%) and the top capital gains tax bracket (18%) creates uncertainty and potential overpayment or underpayment for investors.

India: India imposes a flat 30% tax on all cryptocurrency income and capital gains. Notably, there are no discounts for long-term gains, and no tax benefits are provided for crypto capital losses. Additionally, an extra 1% tax, known as Tax Deducted at Source (TDS), is applied after the initial 30% tax is levied.

These countries present significant challenges for crypto investors, emphasizing the importance of understanding and navigating the complex tax policies governing cryptocurrency transactions.

Should you relocate to one of these countries?

Relocating to one of these crypto-friendly countries raises compelling considerations for investors seeking to optimize their financial positions. The decision to move involves a nuanced evaluation of factors beyond tax implications, including lifestyle preferences, residency requirements, and the overall economic landscape of the chosen destination. While the allure of tax-free crypto transactions is undeniable, individuals must weigh the cost of living, cultural aspects, and potential challenges associated with international relocation. Additionally, staying abreast of evolving crypto regulations in these jurisdictions is crucial, as policy changes can impact the long-term feasibility of such a move. As with any significant decision, consulting with financial advisors and legal experts familiar with both cryptocurrency and international tax laws becomes invaluable. Ultimately, the decision to relocate to a crypto tax haven is a multifaceted one that requires careful consideration of personal and financial objectives.

Things to Think About Before making the move

Before embarking on the journey to a crypto tax-free haven, several crucial considerations demand thoughtful contemplation. First and foremost is an in-depth understanding of the local regulations governing cryptocurrency transactions in the chosen destination. Legislative landscapes can vary significantly, impacting the ease of conducting crypto-related activities. Beyond taxes, factors such as the cost of living, cultural nuances, and language barriers should be thoroughly evaluated. Practical aspects, including visa requirements and residency criteria, play a pivotal role in ensuring a seamless transition. It's essential to gauge the overall stability and economic climate of the destination, as these factors can influence the long-term success of the move. Moreover, establishing a reliable network of legal and financial professionals well-versed in both international regulations and the intricacies of cryptocurrency ensures a well-informed and strategic approach. Careful consideration of these elements will contribute to a more informed decision-making process, ultimately enhancing the likelihood of a successful and harmonious relocation to a crypto-tax-free country.

Conclusion

In conclusion, navigating the intricate intersection of cryptocurrency investments and taxation leads us to a diverse array of nations offering distinct opportunities for enthusiasts and investors. From the alluring 'Blockchain Island' of Malta to the financial haven of Switzerland, these crypto-friendly jurisdictions stand out for their favorable tax conditions or complete exemptions, depending on specific regulatory landscapes and individual circumstances.

As businesses and individuals seek to optimize their financial positions in this dynamic landscape, solutions like BoomFi have emerged to simplify the process of accepting crypto payments. BoomFi offers a seamless way for businesses to start accepting crypto payments, from one-time to recurring transactions, settling in crypto or fiat currencies with ease. With its transparent and affordable pricing models, BoomFi empowers businesses to embrace the cryptocurrency era safely and compliantly.

The prospect of relocating to one of these crypto-friendly countries or integrating innovative solutions like BoomFi raises compelling considerations for those seeking financial optimization. While the allure of tax-free crypto transactions is undeniable, the decision to move or implement new payment methods involves a nuanced evaluation of factors beyond tax implications. Lifestyle preferences, residency requirements, and the overall economic landscape of the chosen destination must be weighed against the benefits. Staying informed about evolving crypto regulations in these jurisdictions and leveraging cutting-edge payment solutions like BoomFi is crucial for making well-informed decisions.

Before embarking on the journey to a crypto tax-free haven or embracing new payment technologies, a thorough understanding of local regulations, evaluation of cultural nuances, and consideration of practical aspects such as visa requirements are imperative. Gauging the overall stability and economic climate of the destination, along with establishing a network of legal and financial professionals, ensures a well-informed and strategic approach. Careful consideration of these elements enhances the likelihood of a successful and harmonious relocation or business transition to a crypto-tax-free country, offering enthusiasts and investors a pathway to financial optimization in the dynamic landscape of digital assets.

Blog/Crypto Tax-Free Countries: A Guide to Minimizing Taxes on Cryptocurrency

Blog/Crypto Tax-Free Countries: A Guide to Minimizing Taxes on Cryptocurrency