Crypto Payments and U.S. Policy: What does Trump's second presidency mean for the Industry’s Next Chapter

Disclaimer: This article doesn’t represent the view of the company; instead, it is an opinionated piece and does not constitute investment or financial advice.

“There are decades where nothing happens, and there are weeks where decades happen.”

The past couple of weeks have indeed felt like this. Following Trump’s victory, Bitcoin’s price continues to break its ATH record, currently, at the time of this writing, trading comfortably in the range of $93,000 - $95,000. While the Trump administration's previous stance on cryptocurrencies was rather negative, the undeniable growth of digital assets and their integration into mainstream finance has ushered the industry to the cusp of transformation.

Yet, the flourishing of newfound innovation and industry expansion opportunities is still at the mercy of progressive regulation. With rising hopes and promises made during the election campaign, many expect forward-looking regulatory reform that will provide clarity for the crypto industry. This article will shed light on what key areas can be potentially propelled under Trump’s second term and the role of crypto payment firms under the new wave of US policies.

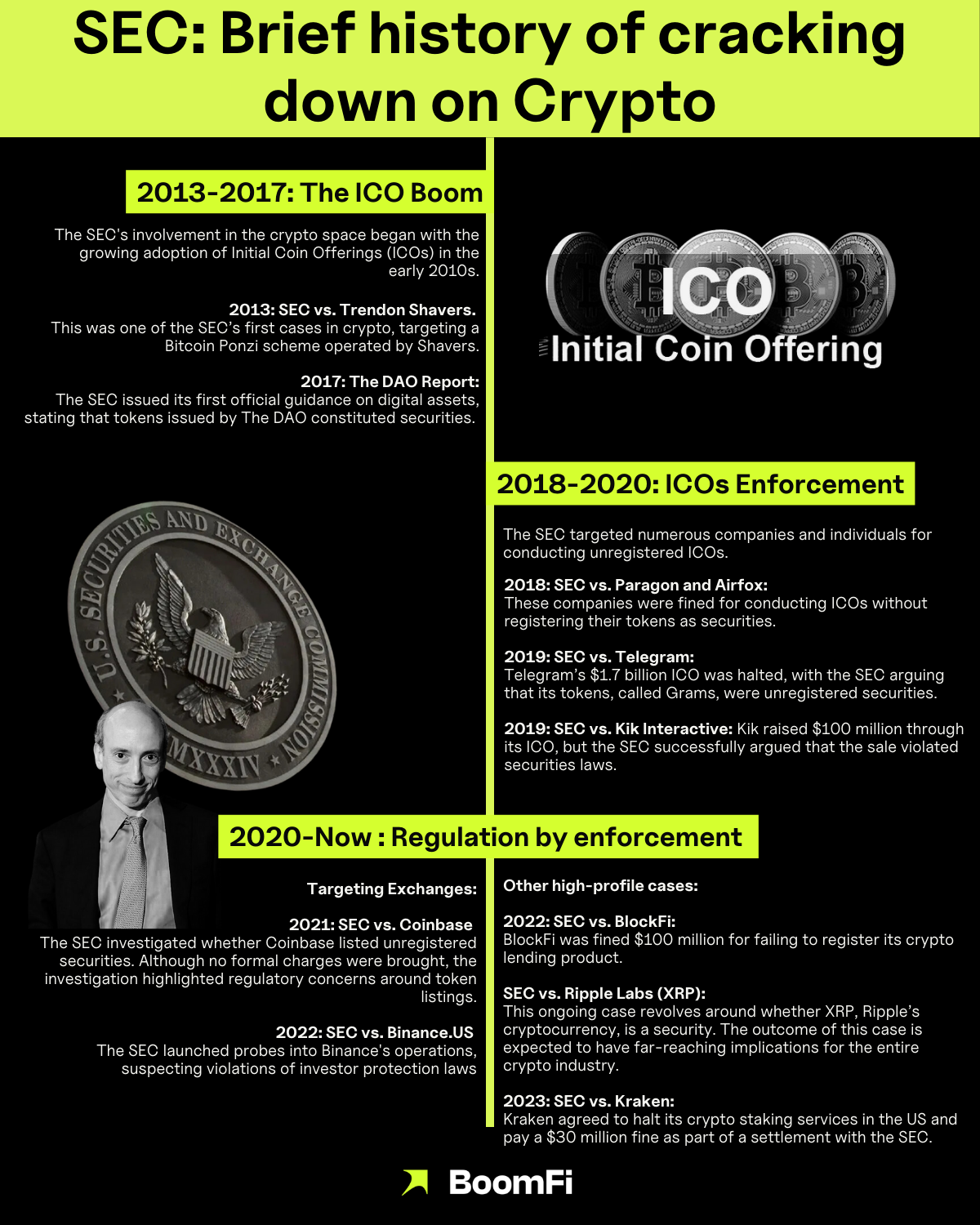

SEC’s history of cracking down on Crypto Companies

It would be negligent to discuss the regulatory landscape in the states without mentioning the Securities and Exchange Commission (SEC). The SEC has played a major role in the crypto industry, characterized by the notorious “regulation by enforcement.” The most common theme throughout the SEC’s approach to regulating crypto is to enforce compliance with federal securities laws. In simpler words, the SEC rules that all crypto assets are securities. This SEC stance was established, further reinforced, and imposed by Gary Gensler, the SEC chairman.

The SEC under Gary Gensler is an era of stringent oversight for the crypto industry, clamming down on ICO companies, exchanges, and DeFi firms for fraud, wash trading, and other violations. While some of the SEC’s enforcement seems necessary, most have been criticized as stifling and hammering the industry’s growth and innovations.

A crypto or token’s use and characteristics can change over time. Applying decade-old precedents, such as Howdy’s test, to policing the use case of advanced technology like blockchain, the underlying cryptocurrency technology is simply insufficient. The legal question of what constitutes a "security" and whether it applies to different crypto asset classes is not always black and white. Thus, it requires more guidance rather than aggressive enforcement. This is precisely where Gary Gensler and his agency have failed to deliver.

Is Trump the answer?

It is worth noting that Trump’s previous presidential term was marked by a somewhat anti-crypto approach. During his presidency, Trump publicly trashed cryptocurrencies, stating that Bitcoin and other digital currencies were "not money" and were based on thin air that could be used to facilitate illegal activities. Furthermore, during this time, the Trump administration facilitated the SEC’s controversial lawsuit against Ripple.

I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity....

— Donald J. Trump (@realDonaldTrump) July 12, 2019

While Trump’s stance on crypto is inconsistent, many still view his current pro-crypto stance positively. “The shift in perspective” indicates that when he is presented with new information, he is open to changes, which is precisely what the industry needs. So far, Trump’s proclamation to make “US the crypto capital of the planet” is slowly materializing. With 296 pro-crypto elected congress members following Gary Gensler’s SEC departure announcement, the market is riding on a massive wave of optimism.

On January 20, 2025 I will be stepping down as @SECGov Chair.

— Gary Gensler (@GaryGensler) November 21, 2024

A thread 🧵⬇️

So, what key areas can be potentially propelled under Trump’s second term?

A clear regulation framework

With an imminent SEC Chair replacement, a pivot from “regulation by enforcement” to a regulatory regime where clear, transparent, and predictable rules are prioritized is expected. When businesses and entrepreneurs are alleviated from the threat of regulatory sanction or personal liability, they will be free to focus on building. As a result, a new class of markets, products, and applications will be brought to the market, facilitating further retail adoption of digital assets. Thus, demand for crypto payment rail is increasing as consumer adoption accelerates under regulation clarity.

The passing of the Fit21Act

The Financial Innovation and Technology (FIT) for the 21st Century Act, introduced in 2023, represents the closest attempt at establishing a regulatory framework for cryptocurrencies. Although some progress has been made, efforts at the federal level have largely stalled. Advancing the FIT21 Act will clarify the distinctions between cryptocurrencies being classified as securities or commodities, thereby increasing oversight in the industry. This approach provides a more nuanced regulatory environment reflecting various crypto assets' diverse nature. As a result, companies will likely feel more secure in accepting cryptocurrency payments and ensuring compliance with relevant regulations.

Stablecoin Expansion

Last week, Howard Lutnick, who has been nominated by Trump for the position of commerce secretary, held discussions with Tether, the organization behind the largest stablecoin, USDT, regarding a $2 billion initiative to offer loans in dollars backed by Bitcoin. Since 98% of stablecoins are tied to the U.S. dollar, this sector provides a chance to strengthen the dollar's worldwide status and enhance U.S. financial influence. Legislation concerning stablecoins is expected to be a top priority for a Republican-led Congress, which aligns with Trump's "America First" agenda. This could create opportunities for cryptocurrency payment companies to act as infrastructure providers for global trade and commerce, thereby improving their competitive standing.

The role of Crypto Payment firms is more vital than ever!

A Growing Market with Untapped Potential

As the need for efficient global payment systems continues to rise, businesses and consumers will look for faster, more affordable, and more secure payment methods. Under the Trump administration, which is not only pro-crypto but also prioritizes economic growth and competitiveness, more people will realize the benefits of using cryptocurrencies to conduct transactions. This, in turn, encourages greater acceptance of digital currencies by mainstream retailers and service providers. As a result, cryptocurrency payment firms are poised to capitalize on this shift.

Institutional Adoption Will Accelerate

A clear and supportive regulatory environment is crucial in facilitating greater participation from institutional players. When regulations are well-defined and aligned with the industry's needs, they provide confidence for financial institutions and corporations to engage with digital assets. Banks should be encouraged to integrate cryptocurrency payment solutions into their existing frameworks. Moreover, multinational corporations could leverage blockchain technology not just for payments but for various aspects of their operations. With increased institutional participation, crypto payment firms can scale their offerings, innovate new products, and expand their market reach. They can also focus on enhancing user experience and security, which are paramount in attracting both consumers and businesses to adopt cryptocurrencies. As more entities enter the space, it creates a virtuous cycle of growth and adoption, ultimately shaping a more robust and integrated financial ecosystem.

The Advantage of Being Early Movers

Merchants and businesses that already tapped into the crypto payment rail are well-positioned to benefit from potential policy shifts. As regulatory frameworks evolve, businesses that prioritize compliance and transparency stand to gain significant advantages over their competitors. This is where crypto payment firms can come in with their compliance-first platform through seamless integration, allowing them to embrace a compliance-centric mindset and demonstrate transparency in their operations. Through leveraging partnerships with leading crypto payment firms, these companies can solidify their positioning as leaders, paving the way for sustainable growth and long-term success as the industry matures.

Parting thoughts

Although the regulatory environment won't change instantly, Trump's second term indicates a significant shift toward a more favorable regulatory approach for cryptocurrency and financial innovation. This can mark the beginning of a golden era for crypto payment firms. By embracing innovation and adapting to evolving regulations, we have the chance to take a leading role in reshaping global finance. With proper planning, we can succeed within a regulated framework, promoting widespread adoption and establishing ourselves as vital elements of the future financial system.

Blog/Crypto Payments and U.S. Policy: What does Trump's second presidency mean for the Industry’s Next Chapter

Blog/Crypto Payments and U.S. Policy: What does Trump's second presidency mean for the Industry’s Next Chapter