Crypto Payment: Who has already accepted it in 2024?

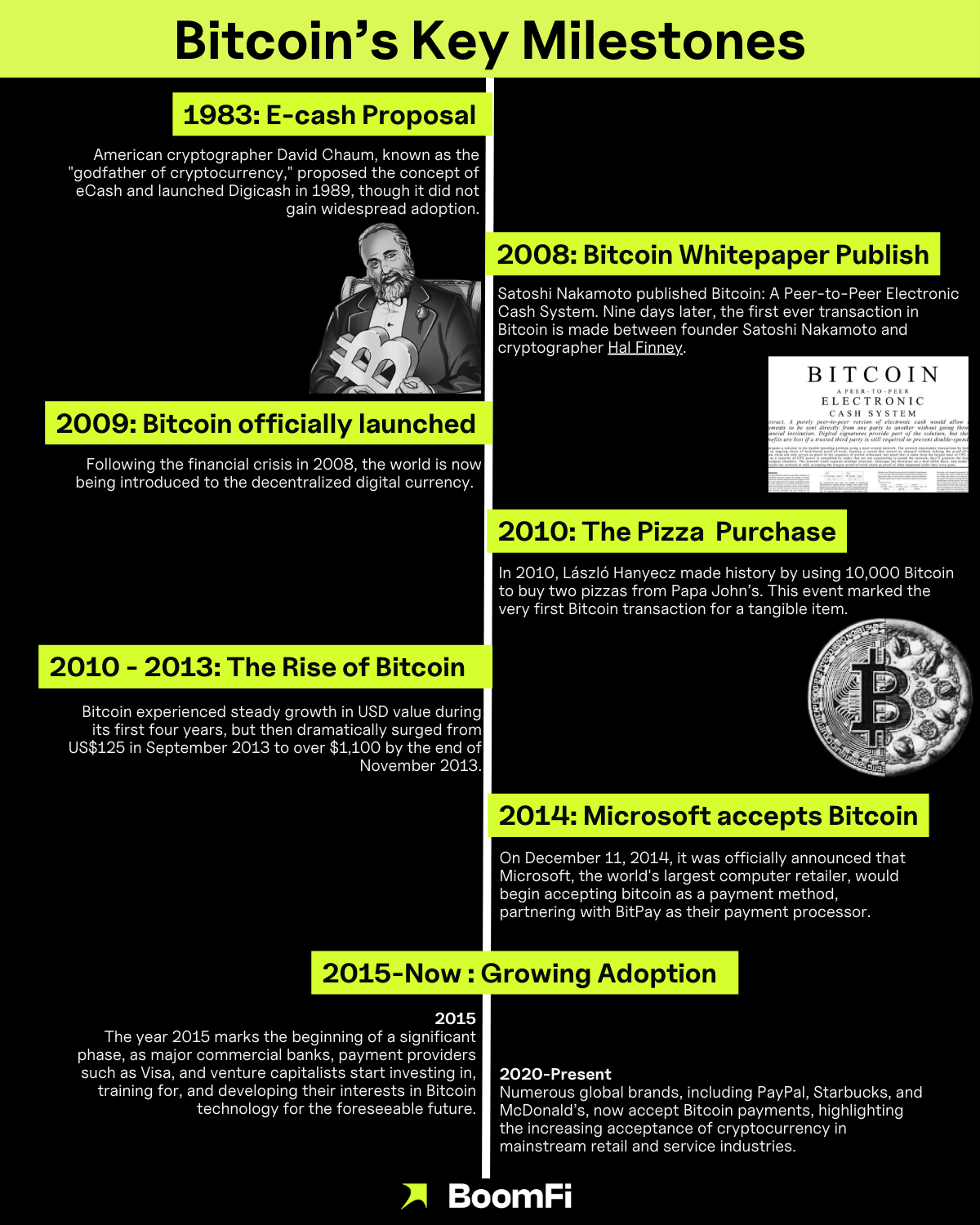

What started as the idea of anonymous electronic money, to the first Satoshi Nakamoto’s Bitcoin whitepaper, is now a full-fledged system allowing and empowering people to conduct daily transactions faster and cheaper than the traditional financial system. Crypto payment has indeed come a long way in proving its value position.

The market is also starting to realize the benefits of blockchain-based payment systems, which are characterized by the growing adoption of stablecoins in retail and enterprises. At the time of this writing, stablecoins’ total transaction volume reached over $228 trillion, accounting for more than 10 billion transactions.

The recently elected Trump administration has introduced numerous pro-crypto policies and initiatives, advocating for regulatory clarity in the classification of digital assets. Globally, governments that support innovation increasingly recognize the advantages and efficiencies of Bitcoin-based payments. Germany has acknowledged Bitcoin as legal tender, while Switzerland’s Crypto Valley stands as a center for blockchain innovations. With the implementation of the Markets in Crypto-Assets (MiCA), Europe's regulatory landscape is becoming more defined. The UK is investigating digital securities through a sandbox at the FCA (Financial Conduct Authority), and its HM Treasury/Exchequer has expressed interest in issuing digital gifts. In Asia, Japan and South Korea lead in Bitcoin adoption, bolstered by regulatory frameworks that promote its usage, particularly in retail and gaming.

Merchants are accepting crypto payments globally!

A steadily growing number of merchants accept Bitcoin and other cryptocurrency payments worldwide. According to Cointelegraph Research, more than 30,000 merchants have already allowed their customers to pay directly with their chosen digital assets or through a third-party payment app.

As we mentioned before, the traditional payment system is inadequate to accommodate global customer preferences. To remain competitive, merchants need to find a cheaper, faster, and more efficient payment solution, taking advantage of lower transaction fees, no currency exchange rates, and enhanced security. That is where crypto payment solutions thrive, helping merchants attract tech-savvy customers and improve their operation efficiency.

There are currently three main ways for users to pay with cryptocurrencies on products and services:

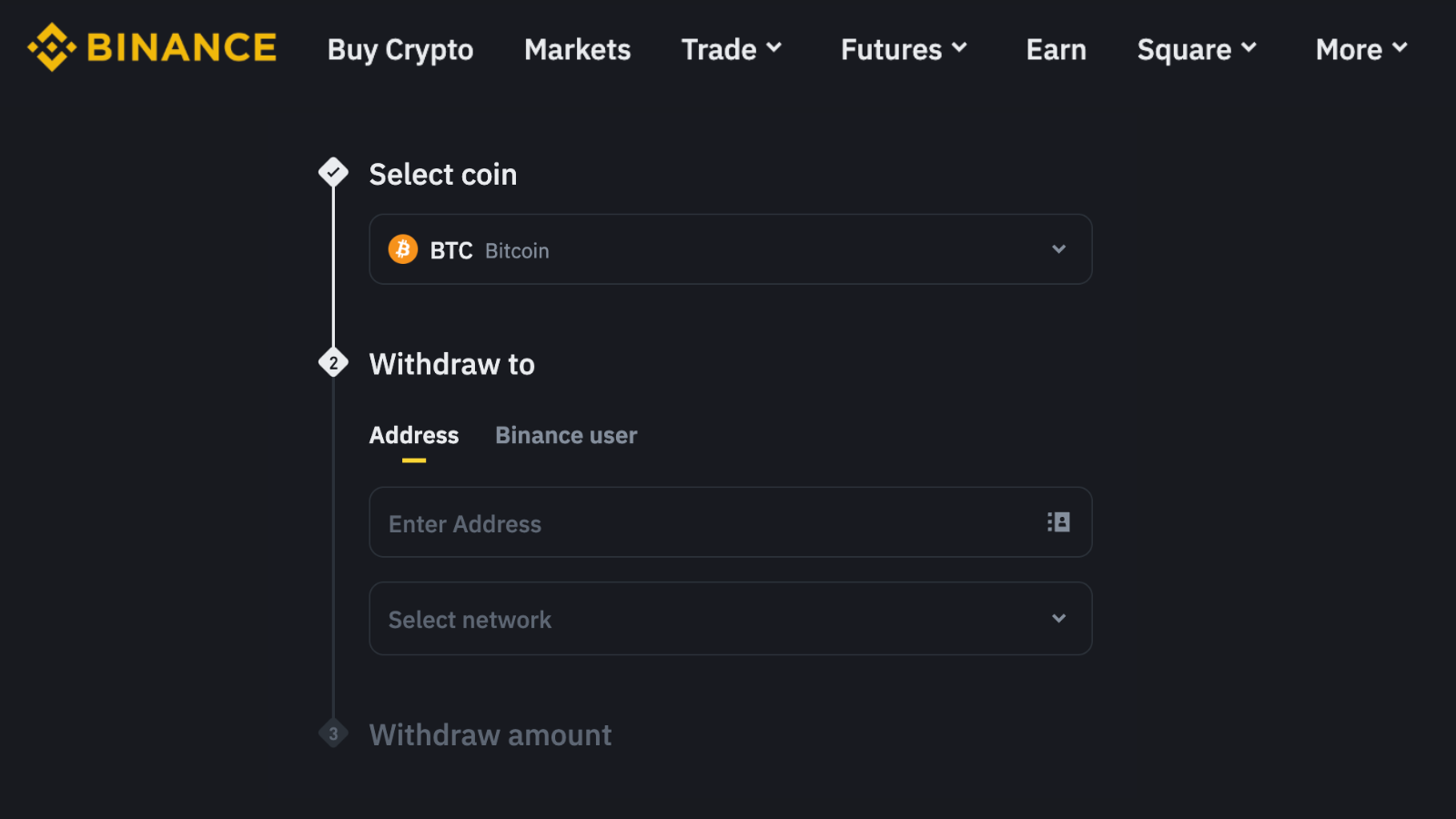

- Via a crypto exchange or a wallet: You can make a direct payment using your preferred cryptocurrencies by choosing the “Send” option in your crypto exchange or wallet. Before you move forward, confirm that you have selected the correct network to prevent any loss of your crypto.

- Via debit cards: A crypto debit card allows customers to bypass the need for vendors to accept Bitcoin payments. To get started, individuals should register with a provider such as Coinbase or Crypto.com, which offers debit cards that support Bitcoin and various other cryptocurrencies. For merchants interested in offering crypto debit cards, Kulipa is an excellent option. They partner with self-custody wallets to provide branded debit cards linked to users' crypto assets, enabling seamless spending just like a traditional debit card. When customers make a purchase, the card automatically loads their cryptocurrencies, converting them into the necessary fiat currency for the transaction.

- Via gift cards: Buying gift cards is a simple method of turning cryptocurrency into real-world goods and services. In addition to popular platforms like Binance and Crypto.com, users can also use their cryptocurrency assets on Bitrefill to purchase gift cards for many well-known national and international brands.

Major brands accepting Bitcoin payments in 2024

Large brands accepting cryptocurrency and digital assets for payments are rapidly rising. Although some continue to view them skeptically, major players in the industry are embracing virtual currencies and have experienced notable success so far.

Apple

In 2012, Apple launched its Tap to Pay feature, which enables payments via "Apple Pay, contactless credit and debit cards, and various digital wallets." Users with a Coinbase Card, Crypto.com Visa Card, or similar payment methods can utilize cryptocurrency for transactions through Tap to Pay. In 2024, Apple plans to allow third-party developers to access the iPhone's near-field communication (NFC) payment chip for transaction processing. This change will enable iPhone users to select a third-party payment app as their default, potentially including options that accept bitcoin, crypto, or stablecoin payments.

Home Depot

As the leading home improvement retailer in the U.S., Home Depot accepts Bitcoin for various equipment, supplies, and services. It simplifies cryptocurrency transactions by utilizing the SPEDN app on the Flexa Network, which allows customers to buy home appliances, garden tools, smart home devices, and building materials.

Chipotle

Chipotle’s owner, Chris Brandt, views Bitcoin as an innovative currency and embraces it as the future. They are committed to fostering the next generation of Chipotle enthusiasts through Web3 initiatives. Currently, many Chipotle locations accept Bitcoin as payment.

ExpressVPN

ExpressVPN, a leading private network service globally, became one of the first major companies to accept this payment method in 2014. Users can now pay for ExpressVPN subscriptions using cryptocurrencies.

Microsoft

In 2014, Microsoft began accepting Bitcoin as a payment method for apps, games, and various digital services. Today, users can also add funds to their Microsoft account using BTC.

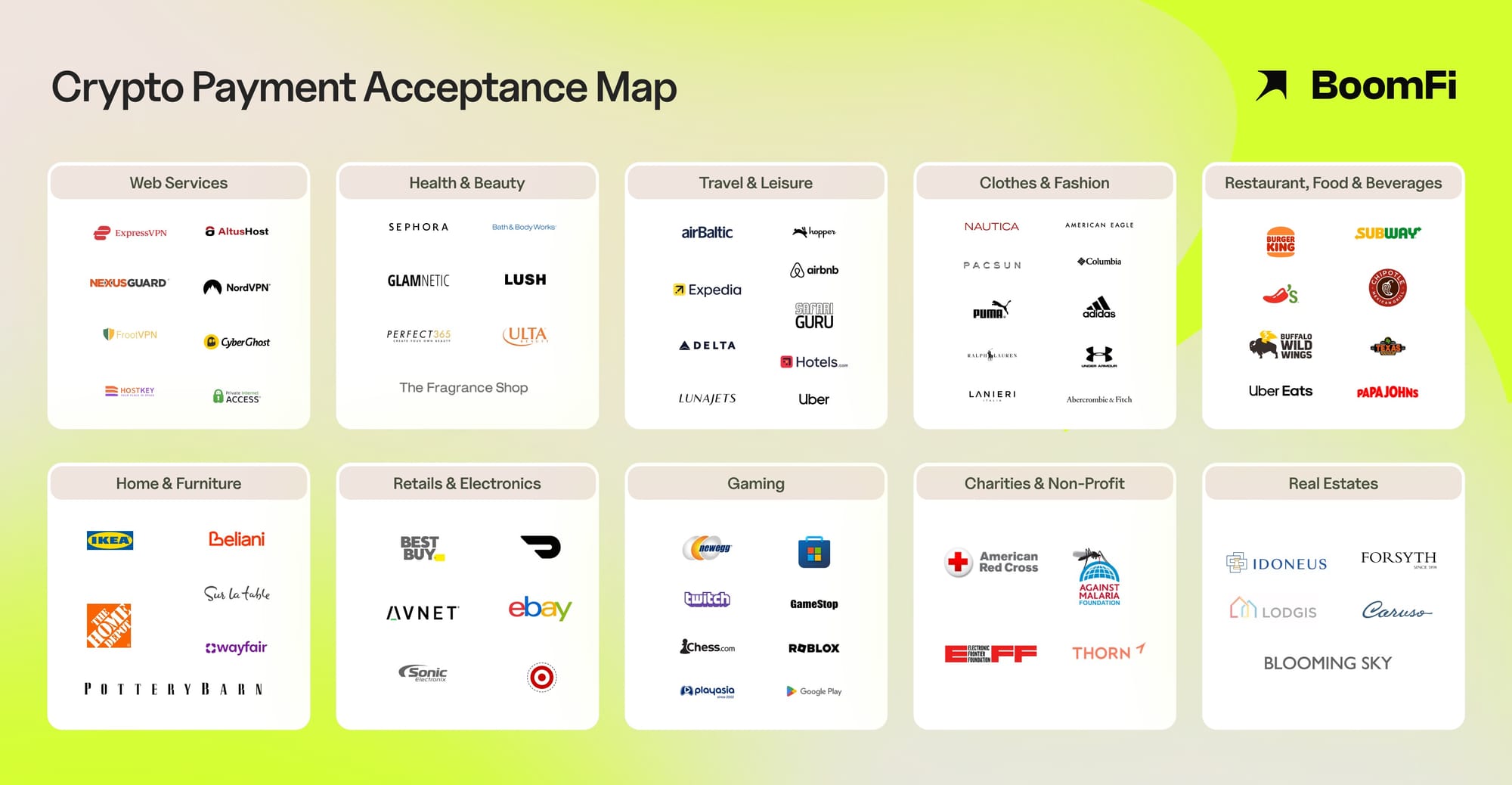

Below is the cryptocurrency payment acceptance map, mentioning many brands that have integrated cryptocurrency payments, allowing customers to pay for their products or services either through gift cards or direct payment. While this isn’t an exhaustive list, the map demonstrates major brands' growing acceptance of cryptocurrency payment options and their widespread across industries. Feel free to contact us if you want to include your brand names on this map.

Outlook for 2025

Cryptocurrency payments are here to stay! Despite initial resistance, many businesses have recognized the advantages of adopting crypto-based payment options. While it remains to be seen whether cryptocurrencies can become a universal payment method, BoomFi is committed to simplifying and optimizing crypto payment solutions, making it easier for businesses to adopt and integrate these innovative payment options into their operations. This commitment not only aims to facilitate smoother transactions but also to educate businesses on the opportunities that blockchain-based payment can offer in an increasingly digitalizing world.

Blog/Crypto Payment: Who has already accepted it in 2024?

Blog/Crypto Payment: Who has already accepted it in 2024?