Bitcoin Halving 2024: How This Event Shapes the Future of BTC

Discover how the Bitcoin Halving event shapes the future of BTC. Learn about its impact on supply, mining incentives, and market anticipation.

What is Bitcoin Halving?

Bitcoin Halving is a crucial event in the Bitcoin network that significantly affects the rate at which new bitcoins are generated. This event occurs approximately every four years and marks a reduction in the reward that miners receive for validating new transactions and adding them to the blockchain.

The Mechanics of Halving

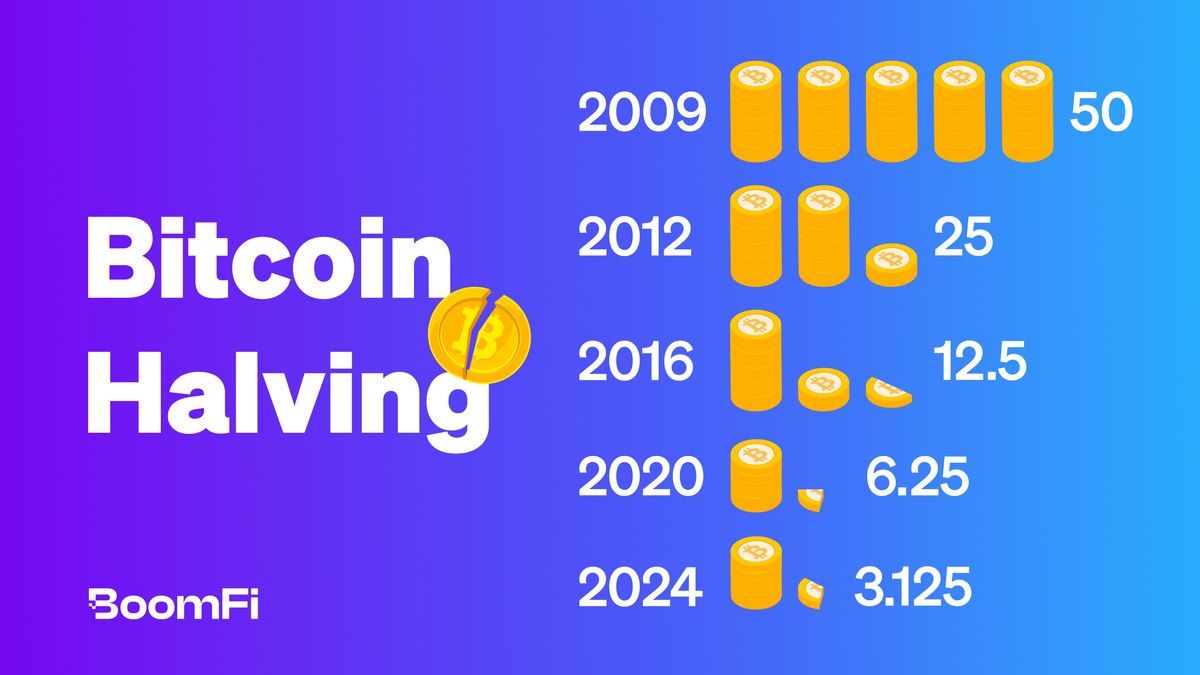

Originally, when Bitcoin was first created, miners received 50 BTC for each block they mined. However, according to Bitcoin's protocol, this reward is halved every 210,000 blocks. As a result:

- In the 2012 halving, the reward dropped from 50 BTC to 25 BTC per block.

- In 2016, it further decreased to 12.5 BTC.

- The most recent halving in May 2020 saw the reward fall to 6.25 BTC.

The upcoming 2024 halving will reduce the block reward to 3.125 BTC.

Impact on Bitcoin's Ecosystem

The halving event is pivotal for several reasons:

- Supply and Demand: The reduction in the rate of new Bitcoin generation effectively limits the supply, which can lead to an increase in Bitcoin's price, assuming demand remains stable or grows.

- Mining Incentives: Miners' earnings are directly impacted. While the immediate effect might not lead to a shutdown of mining operations, it does influence the economics of mining.

- Market Anticipation: Historically, halvings have been followed by significant price increases. For instance, 150 days after the 2012 and 2016 halvings, the price of Bitcoin increased substantially, showcasing the market's response to reduced supply.

- Long-Term Implications: As Bitcoin approaches its total supply limit of 21 million (expected to be reached by 2140), halvings become increasingly significant. Post the limit, miners will rely solely on transaction fees for compensation, marking a shift in the Bitcoin economy.

When is the next Bitcoin Halving?

The next Bitcoin Halving is a highly anticipated event in the cryptocurrency world, slated to occur in 2024. This event, integral to the Bitcoin network, follows a pre-set schedule, happening approximately every four years or after every 210,000 blocks are mined.

The 2024 Halving Timeline

- Estimated Date: The exact date of the halving can fluctuate due to the variable time it takes to mine blocks, but it is currently estimated to happen on or around April 17, 2024.

- Block Count: The halving will occur at block 840,000. As of the latest data, there are about 20,103 blocks remaining until this milestone is reached.

Countdown to the Halving

With a countdown of about 133 days left, the crypto community and miners are closely watching the developments. This countdown is not just a marker of time but also signifies a shift in the mining rewards and potential market impacts.

Significance of the Date

The anticipation surrounding the exact date stems from historical trends where previous halvings have led to significant price movements and shifts in mining strategies. The 2024 halving will reduce the mining reward from 6.25 BTC to 3.125 BTC per block, marking another step towards the total cap of 21 million Bitcoins.

Preparing for Change

Investors, traders, and miners alike are preparing for this event, as it historically signifies not just a reduction in supply but potential changes in the market dynamics of Bitcoin. Understanding the timing is crucial for strategic planning and decision-making in the Bitcoin ecosystem.

How often does Bitcoin Halving occur?

Bitcoin Halving is a programmed event in the Bitcoin network that takes place at regular intervals. Understanding its frequency is crucial for both long-term investors and participants in the Bitcoin ecosystem.

The Halving Cycle

- Frequency: Bitcoin Halving occurs every 210,000 blocks. Given the average time it takes to mine a block, this event roughly happens once every four years.

- Predictability: Unlike many market events, the timing of Bitcoin Halvings is predictable, governed by the network's underlying code rather than external factors.

Historical Context

- First Halving: The inaugural Bitcoin Halving occurred in November 2012, when the reward for mining a block was halved from 50 BTC to 25 BTC.

- Subsequent Halvings: Following this, the second and third halvings took place in July 2016 and May 2020, reducing the rewards to 12.5 BTC and then 6.25 BTC, respectively.

Looking Ahead

- Future Halvings: After the 2024 halving, the subsequent events are projected for 2028, 2032, and so on, continuing until the final Bitcoin is mined. This process contributes to Bitcoin's deflationary nature.

Impact of Halving Events

- Supply Implications: Each halving reduces the rate at which new bitcoins are created, slowing down the inflation rate of Bitcoin and impacting its overall supply.

- Market Anticipation: These events are often marked by significant attention and speculation, as past halvings have been associated with notable price movements in the Bitcoin market.

Conclusion

Bitcoin Halving is a fundamental aspect of Bitcoin's design, ensuring a controlled and diminishing issuance of new coins. This regular, approximately four-year cycle not only maintains a check on inflation but also plays a significant role in Bitcoin's long-term value proposition and market dynamics. As such, each halving is a milestone, closely watched by the cryptocurrency community.

What is the purpose of Bitcoin Halving?

Bitcoin Halving serves as a critical mechanism in the Bitcoin network, designed with specific intentions that have far-reaching implications for the cryptocurrency.

Controlling Bitcoin's Supply

- Finite Supply: Bitcoin's total supply is capped at 21 million coins. Halving ensures that the creation of new bitcoins slows down over time, making Bitcoin a deflationary asset.

- Inflation Rate: By reducing the block reward given to miners, halving decreases the rate at which new bitcoins are created, effectively lowering Bitcoin's inflation rate.

Economic Incentives

- Miner Motivation: Initially, mining rewards are high, incentivizing network participation. Over time, as rewards decrease, the system is designed to transition to transaction fees to compensate miners.

- Long-Term Sustainability: This gradual shift from block rewards to transaction fees is intended to maintain miner participation and network security even after all bitcoins are mined.

Market Impact

- Price Implications: Historically, halvings have been followed by periods of increased Bitcoin prices. This pattern is attributed to the reduced supply of new bitcoins entering the market, which, if demand remains constant or increases, can lead to price appreciation.

- Investor Interest: Each halving event brings heightened attention to Bitcoin, often sparking discussions about its long-term value and role as a digital asset.

Historical Perspective

- Past Halvings: The first halving in 2012 reduced the reward from 50 to 25 BTC, the second in 2016 to 12.5 BTC, and the third in 2020 to 6.25 BTC. Each event was followed by a notable increase in Bitcoin's price, although it's important to note that past performance doesn't guarantee future results.

Looking Forward

- Future Outlook: As we approach future halvings, the crypto community closely monitors how these events will shape Bitcoin's economics, particularly in terms of miner behavior and market dynamics.

Conclusion

The purpose of Bitcoin Halving is multifaceted, balancing economic incentives for miners, controlling the supply of new bitcoins, and potentially impacting Bitcoin's market value. It is a fundamental aspect of Bitcoin's design, playing a key role in its narrative as a digital store of value and its adoption as a mainstream financial asset.

How does Bitcoin Halving affect the price of Bitcoin?

Bitcoin Halving is a significant event in the cryptocurrency world, and its impact on the price of Bitcoin is a topic of keen interest and speculation. While the exact outcome of each halving is unpredictable, historical trends offer some insights.

Supply-Demand Dynamics

- Reduced Supply: Each halving reduces the rate at which new bitcoins are introduced into circulation, effectively halving the rate of new supply.

- Demand Side: If demand remains constant or increases, the reduced supply rate can lead to a price increase, as seen in traditional supply-demand economics.

Historical Price Movements

- Post-2012 Halving: Following the first Bitcoin Halving in November 2012, the price of Bitcoin saw a significant increase, rising from about $12 to $127 within 150 days.

- 2016 Halving Impact: The second halving in July 2016 also resulted in a notable price increase. Bitcoin's price rose from around $650 on the day of the halving to approximately $758 over the next 150 days.

- 2020 Halving: The most recent halving in May 2020 led to a considerable price surge in the following year, with prices climbing from about $8,821 to over $10,943.

Market Sentiment and Speculation

- Expectations: Leading up to a halving, there's often increased market speculation and interest, which can also drive up the price.

- Investor Behavior: Both retail and institutional investors tend to adjust their strategies based on halving events, which can influence market dynamics.

Long-Term Trends

- Sustained Growth: Despite short-term volatility, the long-term trend following halving events has generally shown sustained growth in Bitcoin's price.

- Future Predictions: While past performance is not indicative of future results, each halving renews discussions about Bitcoin's long-term value as a digital asset.

What is the expected impact of the upcoming Bitcoin Halving?

The upcoming Bitcoin Halving, anticipated in 2024, is generating considerable interest within the cryptocurrency community, with various expectations about its potential impact.

Supply Reduction and Price Implications

- Reduced Block Reward: The halving will decrease the mining reward from 6.25 BTC to 3.125 BTC per block, effectively slowing down the rate at which new bitcoins are created.

- Historical Trends: Previous halvings have often led to significant price increases in the months following the event, driven by the reduced rate of new supply entering the market.

Mining Ecosystem Changes

- Miner Profitability: The reduction in block rewards will impact miners' profitability, potentially leading to a temporary drop in mining activity as less efficient miners may find operations unviable.

- Network Security: A key consideration is how the reduction in mining rewards will affect the overall security of the Bitcoin network, though historically, the network has remained robust post-halving.

Market Speculation and Investor Sentiment

- Anticipation: As with past halvings, market speculation and investor sentiment play a significant role in shaping the price leading up to and after the event.

- Long-Term Outlook: Investors and analysts will be keenly observing the halving to assess its impact on Bitcoin's position as a digital store of value and its mainstream adoption.

Potential Scenarios

- Bullish Scenario: A common expectation is a bullish trend, where the price of Bitcoin may rise significantly post-halving, similar to previous cycles.

- Cautious Outlook: However, it's important to note that past performance is not indicative of future results, and the market could respond differently due to various macroeconomic factors and evolving market dynamics.

External Factors

- Global Economic Environment: The broader economic context, including inflation rates, institutional adoption of Bitcoin, and regulatory developments, could influence the impact of the halving.

How Will the Bitcoin Halving Affect Miners?

Bitcoin Halving has a direct and significant impact on miners, as it directly affects their primary revenue stream.

Reduction in Rewards

- Immediate Impact: The most obvious effect of the halving is the reduction in the block reward. Post-2024 halving, this will drop from 6.25 BTC to 3.125 BTC per block.

- Revenue Implications: This decrease in rewards means that miners will earn less Bitcoin for each block they successfully mine, potentially impacting their profitability.

Adjustments in Mining Operations

- Cost-Benefit Analysis: Miners will have to reassess their operations, considering electricity costs, hardware efficiency, and other operational expenses against the reduced rewards.

- Potential Consolidation: Less efficient mining operations might find it hard to sustain profitability, leading to a consolidation in the mining industry with larger, more efficient players dominating.

Long-Term Sustainability

- Transition to Transaction Fees: As block rewards diminish over time, transaction fees are expected to become a more significant part of miners' income, ensuring the long-term sustainability of mining operations.

Conclusion

Bitcoin Halving poses a challenge to miners, particularly those with higher operational costs. It necessitates a reassessment of mining strategies and could potentially lead to changes in the mining landscape, favoring more efficient and larger-scale operations.

How Does Bitcoin Halving Affect the Rate of Block Production?

Bitcoin Halving does not directly affect the rate at which blocks are produced in the Bitcoin network, but it can have indirect implications.

Block Production Rate

- Consistent Rate: The Bitcoin protocol is designed to produce a new block approximately every 10 minutes. This rate does not change with halving.

- Difficulty Adjustments: The Bitcoin network automatically adjusts the difficulty of mining to ensure that the block production rate remains consistent, regardless of the number of miners or the total hashing power.

Indirect Effects

- Miner Participation: If the halving significantly reduces profitability for some miners, they may exit the network, temporarily affecting the total hashing power.

- Difficulty Rebalancing: The Bitcoin network will adjust the mining difficulty accordingly to maintain the 10-minute block production rate, even if some miners drop out.

Embracing the Future with BoomFi: The Ideal Companion in the Era of Bitcoin Halving

As we explore the intricacies and impacts of Bitcoin Halving, businesses and individuals involved in the cryptocurrency space must adapt and evolve. This is where BoomFi comes into play, providing an essential toolset for navigating the changing tides of cryptocurrency transactions, especially during pivotal events like Bitcoin Halving.

Why BoomFi in the Context of Bitcoin Halving?

- Adaptability to Market Shifts: Bitcoin Halving signifies changes in the cryptocurrency ecosystem, particularly in terms of mining rewards and potential market volatility. BoomFi offers a stable platform for businesses to continue their operations smoothly during these transitions.

- Seamless Crypto Transactions: With features like Pay In, Pay Out, and a robust Fiat <> Crypto Exchange system, BoomFi enables businesses to manage their crypto transactions efficiently, a necessity in the fluctuating post-halving landscape.

- Innovative Solutions for New Challenges: As Bitcoin Halving potentially alters market dynamics, BoomFi's innovative tools like recurring crypto payments and gas-less transactions provide businesses with the flexibility to adapt to new financial environments.

How BoomFi Enhances Business Operations Post-Halving

- Diverse Payment Options: Whether it’s integrating crypto payments or converting them to fiat, BoomFi's wide range of services ensures that businesses can navigate the post-halving period with ease.

- Transparent and Affordable Pricing: With the potential financial shifts post-halving, BoomFi's clear and cost-effective pricing model becomes even more valuable for businesses keeping a close eye on expenses and revenues.

- Future-Proof Your Business: As the crypto world continues to evolve, BoomFi's commitment to incorporating upcoming features like card payment methods aligns your business with future advancements.

Conclusion: BoomFi as Your Strategic Partner in the Halving Era

The upcoming Bitcoin Halving is more than just a technical milestone; it's a marker of the maturing cryptocurrency landscape. For businesses engaged in this space, BoomFi is not just a tool but a strategic partner that helps navigate the complexities of cryptocurrency transactions in these changing times. By choosing BoomFi, businesses can ensure they are well-equipped to handle the challenges and opportunities that arise from such pivotal events as Bitcoin Halving.

Ready to revolutionize your crypto transaction processes and stay ahead in the halving era? Connect with BoomFi and be part of this exciting journey into the future of cryptocurrency. Visit BoomFi's website to learn more and join the community on LinkedIn, Twitter, and Telegram.

Blog/Bitcoin Halving 2024: How This Event Shapes the Future of BTC

Blog/Bitcoin Halving 2024: How This Event Shapes the Future of BTC